Introduction

When thinking about precious metals, most people immediately picture gold and silver. However, these precious metals are increasingly finding their way into investment portfolios—and for good reason. These lesser-known metals play crucial roles in modern industries, particularly in automotive and green technology, while also offering diversification for investors.

In April’s blog, we’ll explore the unique qualities of these metals, discuss their industrial applications, and provide insights into how you can incorporate them into your investment strategy. Let’s dive into why these “underdog” metals are worth your attention.

Learn about Platinum and Palladium

Platinum and palladium are part of the platinum group metals (PGMs), a family of rare, precious metals with remarkable physical and chemical properties.

Platinum

Known for its silvery-white appearance and density, platinum is rarer than gold and boasts exceptional resistance to corrosion. It is widely used in jewelry, industrial applications, and investment-grade bullion.

Featured Product: 2026 Canadian Platinum Maple Leaf 1 oz

2026 Canadian Platinum Maple Leaf 1 oz BU coin. .9995 fine platinum featuring King Charles III and iconic maple leaf design. Brilliant Uncirculated condition.

Palladium

Palladium, a sister metal to platinum, is lighter and has a more understated luster. Despite being less recognized, its rarity and industrial significance make it equally valuable. Both metals are mined primarily in Russia and South Africa, contributing to their limited supply and price volatility.

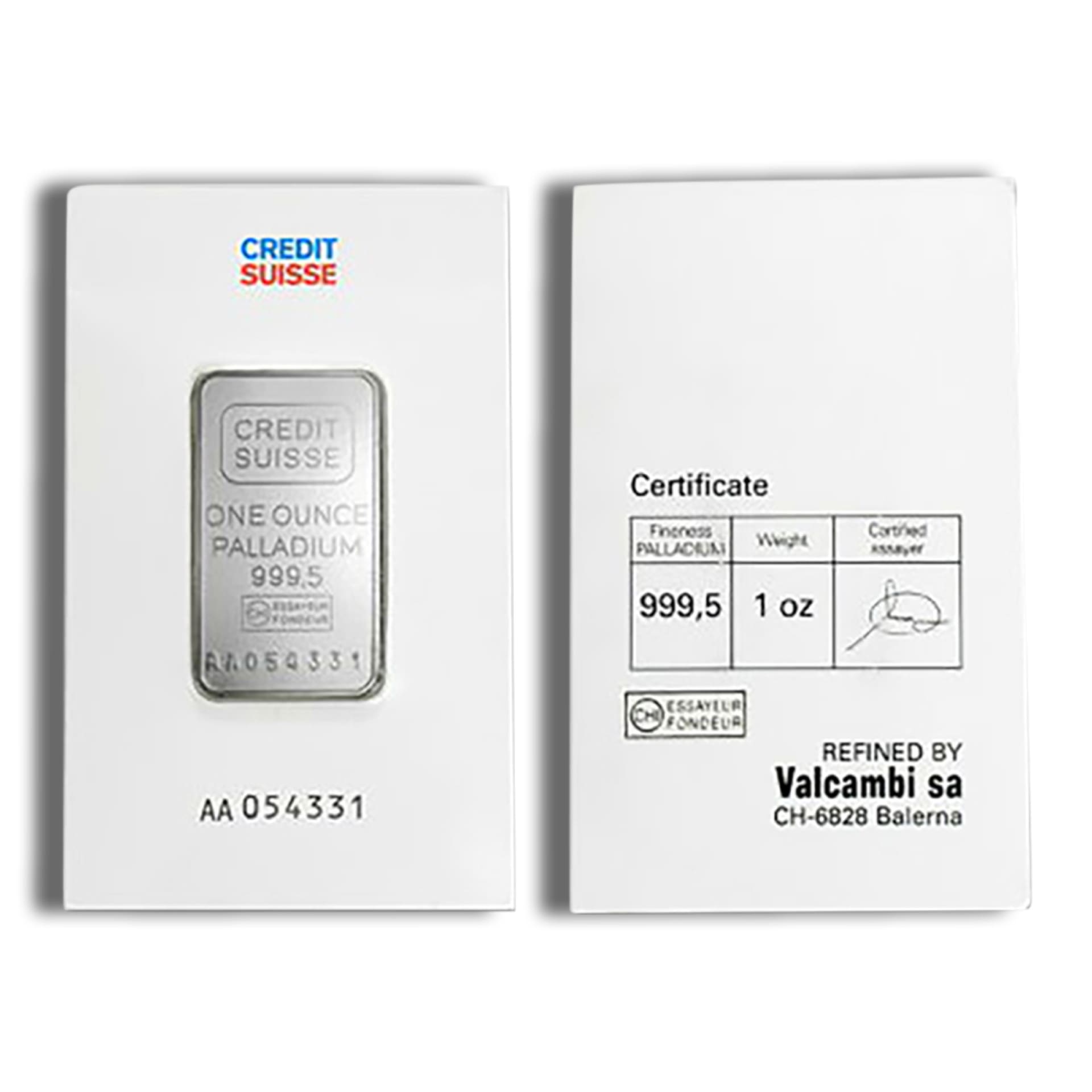

Featured Product: 1 oz Credit Suisse Palladium Bar

1 oz Credit Suisse Palladium Bar – .9995 fine palladium with a serialized assay card, offering LBMA-certified quality and worldwide liquidity.

Why Platinum and Palladium Gaining Popularity

1. Demand in the Automotive Industry

Platinum and palladium are indispensable in catalytic converters, which reduce harmful emissions in gasoline and diesel engines. Palladium is predominantly used in gasoline engines, while platinum is more common in diesel engines.

With governments worldwide imposing stricter emissions standards, the demand for these metals remains strong. Precious Metals Trends

2. The Rise of Green Technology

Platinum is essential in hydrogen fuel cells, a promising alternative energy source. As the push for cleaner energy grows, so does the potential demand for platinum in hydrogen-powered vehicles and renewable energy systems.

3. A Hedge Against Economic Uncertainty

Like gold and silver, platinum and palladium serve as safe-haven investments during economic instability. Their rarity and industrial importance make them valuable commodities for diversifying portfolios.

4. Increasing Investment Options

The availability of platinum and palladium coins, bars, and ETFs has grown in recent years, making it easier for investors to gain exposure to these metals.

How Platinum and Palladium Compare to Gold and Silver

While gold and silver dominate the spotlight, platinum and palladium offer unique advantages that complement traditional precious metals investments.

| Feature | Gold | Silver | Platinum | Palladium |

| Primary Use | Jewelry, investment | Jewelry, industry | Industry, jewelry | Industry |

| Industrial Demand | Moderate | High | High | Very High |

| Price Volatility | Moderate | High | High | Very High |

| Rarity | Moderate | Low | High | Very High |

| Market Liquidity | High | High | Moderate | Moderate |

With heavy reliance on industrial demand introduces higher price volatility, but this also creates opportunities for significant gains during bull markets.

Investment Opportunities in Platinum and Palladium

1. Coins and Bullion

Physical precious metal products are an excellent way to own tangible assets. Popular options include:

- Platinum American Eagle: A highly liquid coin backed by the U.S. government.

- Palladium Canadian Maple Leaf: Known for its purity and intricate design.

- Platinum Bars: Available in various sizes, ideal for bulk investments.

2. ETFs

Exchange-traded funds (ETFs) allow you to invest in platinum and palladium without physically storing them. ETFs track the price of these metals, offering a convenient way to gain exposure.

3. Mining Stocks

Investing in companies that mine platinum and palladium provides indirect exposure to these metals. While riskier than direct investments, mining stocks often offer higher returns during bull markets.

4. Futures Contracts

For advanced investors, futures contracts provide opportunities to speculate on the price movements of platinum and palladium. However, they require significant expertise and carry higher risks.

Diversifying a Modern Risks and Considerations for Collectors

Before investing in platinum and palladium, it’s essential to understand their unique risks:

1. Price Volatility

Prices highly sensitive to industrial demand, geopolitical factors, and mining disruptions. This volatility can lead to significant price swings.

2. Limited Market Liquidity

Compared to gold and silver, the markets for platinum and palladium are smaller, which can make it harder to buy or sell large quantities.

3. Supply Concentration

With most platinum and palladium production concentrated in Russia and South Africa, political or economic issues in these regions can disrupt supply and impact prices

Tips for First-Time Investors

Ready to add platinum or palladium to your portfolio? Here are some tips to get started:

- Start with Coins or Small Bars: Begin with affordable products like the Platinum American Eagle or a 1 oz palladium bar.

- Diversify Your Holdings: Combine platinum and palladium with gold and silver to create a balanced portfolio.

- Monitor Market Trends: Stay informed about industrial demand and geopolitical factors that influence prices.

- Buy From Trusted Dealers: Ensure authenticity by purchasing from reputable sources like Coins Online.

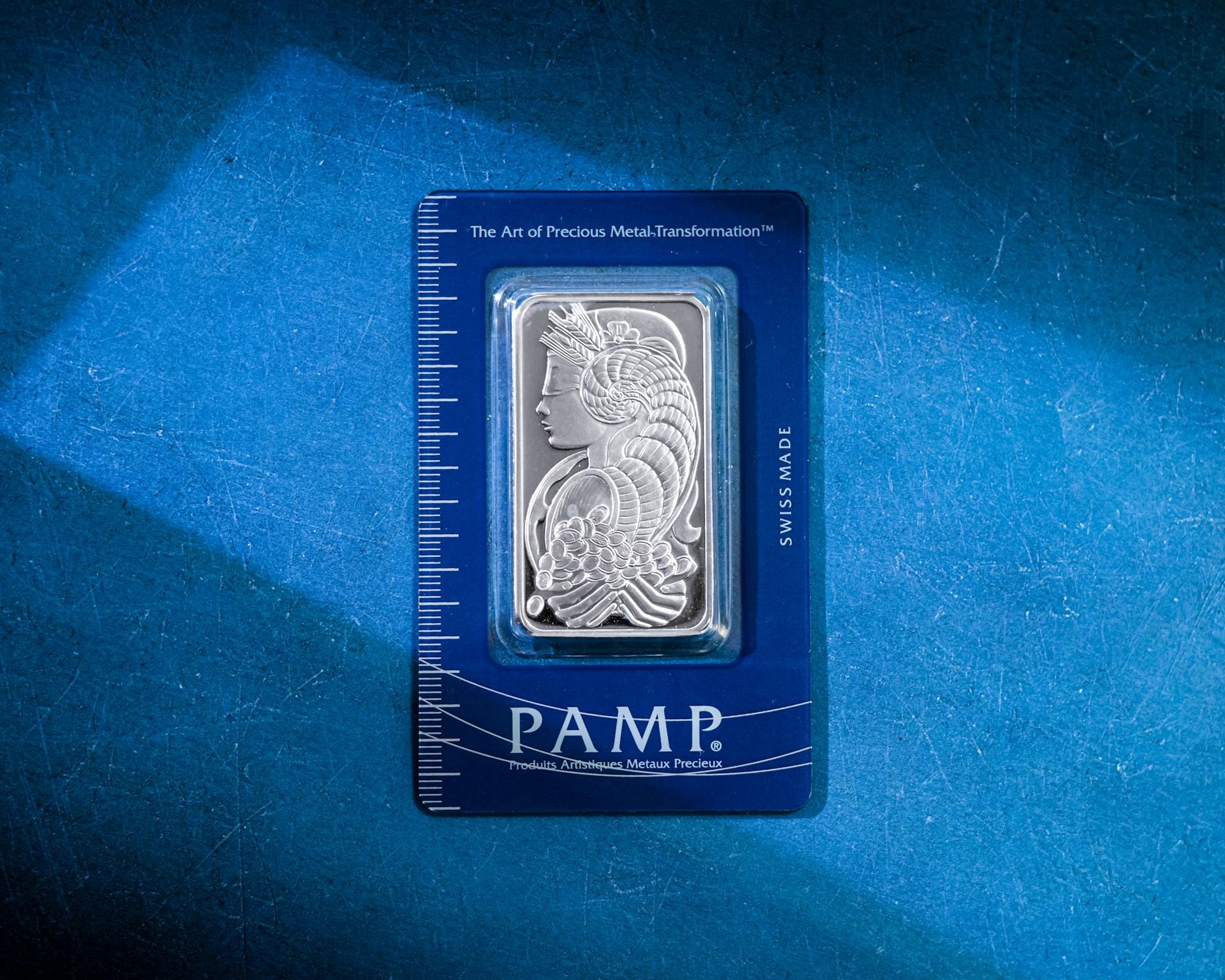

1 oz Platinum Bar – Varied Mints

1 oz Platinum Bar in .9995 fine assay packaging. Sourced from LBMA-approved refiners—trusted platinum for secure long-term collecting.

In stock

Conclusion: Platinum and Palladium—The Hidden Gems of Precious Metals

Platinum and palladium may not enjoy the same level of recognition as gold and silver, but their industrial applications and rarity make them invaluable additions to any diversified portfolio. In 2025, these metals are poised for growth, driven by advancements in automotive and green technologies.

Whether you’re intrigued by their industrial significance or their potential for high returns, these metals offer a unique opportunity for forward-thinking investors. Coins Online provides a range of platinum and palladium products, from collectible coins to investment-grade bars, to help you get started.

Why Platinum and Palladium Deserve Collector Attention

In 2025, platinum and palladium are more than niche metals—they’re pivotal materials in modern industry. Whether in automotive catalytic converters, hydrogen fuel cells, or green tech components, their industrial utility blends with rarity to create growing collector appeal.

Collector Insights and Market Dynamics

- Platinum banks on durability and scarcity, with uses in jewelry, medical applications, and renewable energy hardware.

- Palladium is lighter and plays a key role in gasoline-engine emissions control. Restricted supply from Russia and South Africa adds to its value story.

- As emission regulations tighten and green tech evolves, demand for both metals continues climbing.

Smart Collector Strategies

- Consider .9995 purity coins like the Platinum American Eagle or Platinum Maple Leaf for recognized authenticity.

- Add palladium bars or Canadian Palladium Maple Leaf coins for unique diversification to your collection.

- Track macro indicators—automotive output, energy mandates, and emissions trends—to inform when the market’s industrial demand drives value.

How Coins Online Supports Confidence in These Metals

Every product we list—from coins to bars—is verified for purity, weight, and authenticity. With assay packaging where available, transparent pricing, and trusted refiners, you’re equipped to build a thoughtful, lasting collection rooted in clarity.

Related Collector Resources

How to Spot Fake Gold

https://www.coinsonline.com/education/learn-spot-fake-gold/

Gold Premiums Explained

https://www.coinsonline.com/education/learn-gold-premiums-explained/

Learn What Qualifies for IRA Approved Gold

https://www.coinsonline.com/education/learn-ira-approved-gold/

Frequently Asked Questions About Platinum and Palladium

Why are platinum and palladium gaining collector interest?

Their rarity combined with critical roles in catalytic converters, hydrogen fuel cells, and green technology make them increasingly sought after by collectors interested in both utility and scarcity.

Which formats are most recognized for these metals?

Popular choices include the Platinum American Eagle, Canadian Platinum Maple Leaf for platinum, and Canadian Palladium Maple Leaf or LBMA-certified palladium bars for palladium.

How does industrial demand impact platinum and palladium prices?

Unlike gold, these metals’ prices closely mirror demand from industries like automotive and green energy, making them more volatile but also potentially more rewarding during demand surges.

Is liquidity different for platinum and palladium?

The market for these metals is smaller than gold’s, which can limit liquidity slightly—especially for large orders or less common products.

How can collectors stay informed about demand trends?

Monitor automotive production reports, emissions standards, energy policies, and supply chain updates related to mining in key regions like Russia and South Africa.

Leave a Reply